Credit: Scott McIntyre/Bloomberg | Angus Mordant/Bloomberg

A rare thing took place last week: Detroit learned it is getting a new Hilton hotel.

Yet Hilton’s chief rival, Marriott, has a nearly five-to-one advantage in terms of hotel and other lodging keys available or under construction in the city, putting the Hilton at a sizable disadvantage — at least for now — in the race to build more accommodations for downtown travelers.

For years, Detroit’s convention and tourism industry has argued that the city’s downtown core and surrounding areas are underserved by hotels, which is causing it to lose revenue to other cities with more robust stock.

The June 2 announcement that Michigan Central Station is expected to become home to one of the few luxury NoMad brand hotels in the world — so far — brings McLean, Va.-based Hilton Worldwide Holdings Inc. to two flags announced in the last decade in and around downtown.

The other Hilton property is the Godfrey Hotel (227 rooms) in Corktown, which opened in August 2023; the NoMad would have about 180 rooms.

On the other hand, its chief rival, Bethesda, Md.-based Marriott International Inc., has opened or announced no fewer than seven, ranging from the new convention-style JW Marriott Detroit Water Square with 600 rooms now under construction to the 227-room Edition hotel in the Hudson’s Detroit development.

Other recent additions to Marriott’s Detroit portfolio — both owned hotel flags and affiliated, but not owned — include The Element Detroit at the Metropolitan, the Sonder Gabriel Richard, the AC Hotel Detroit, the David Whitney Building, Autograph Collection and the Apartments by Marriott Bonvoy.

Credit: Neumann/Smith Architecture

A rendering of the under-construction JW Marriott Detroit Water Square convention hotel on the Detroit riverfront.

That doesn’t even include the existing Marriott hotels in the city, ranging from the state’s tallest building, the 1,300-room Detroit Marriott at the Renaissance Center to its neighbor across Jefferson Avenue, the Courtyard Detroit Downtown (265 rooms). There are also the Westin Book Cadillac (454 rooms) and MGM Grand (400 rooms that are affiliated, although not owned).

For its part, Hilton also has the Hilton Garden Inn (198 rooms) on Gratiot Avenue and the DoubleTree (203 rooms) on Fort Street.

In all, Hilton has a little over 800 rooms existing or announced in and around downtown, while Marriott has more than 3,880, according to a Crain’s tally based on previous reporting and information in CoStar Group Inc., a Washington, D.C.-based real estate information service.

That discrepancy favors Hilton for new product in the coming years, said Greg Denton, director of the real estate minor in the School of Hospitality Business within the Michigan State University Eli Broad College of Business.

“Although Marriott is by no means saturated in Detroit and could easily accommodate more properties within their 30-plus brands, the relative imbalance between Marriott and Hilton will likely favor Hilton for future deals as there’s an even greater need for additional Hilton product in the market,” Denton said.

Credit: Westin Book Cadillac

The Westin Book Cadillac in Detroit, a Marriott property, reopened in 2008 after a $23 million renovation.

It’s not necessarily hotel chains like Marriott and Hilton themselves in the driver’s seat.

Those companies generally collect management and franchise fees — which are typically based on room rental income and vary brand by brand — while the developer typically owns the building and assumes the majority of the risk with things like construction loans and other obligations.

Claude Molinari, chair of the Detroit Regional Convention Facility Authority board and president and CEO of the Detroit Metro Convention and Visitors Bureau, said property owners can have chains with which they prefer to work, which can help lead to a disparity.

“In a lot of respects, it’s private management and owners making these choices,” Molinari said, adding that property owners can have leverage in negotiations. “If an owner has five (Marriott) hotels in the region, when they are building their sixth one, if they’ve already got Marriott properties, they can say, ‘Only charge me 85% of the management fee.’”

It’s not uncommon for one hotel chain or another to be dominant in certain markets, said Dan McCoy, senior managing director and regional practice leader for HVS Inc., a hospitality research company based in Tennessee.

Credit: CoStar Group Inc.

The center tower of the Renaissance Center, the state’s tallest building, is home to a 1,300-room Marriott hotel.

For example, McCoy said, Hilton at one point had been the go-to chain in Memphis. But when Hilton or Marriott — or both — have an outsized footprint in a particular area, that has ripple effects.

“There’s a bit of a pendulum swing,” McCoy said. “If things get tilted too far, then alternative brands become that much more attractive because you’re sharing a reservation system with fewer competitive properties.”

Those alternative brands to the Marriott and Hilton, which Molinari likened to Coke and Pepsi, respectively, include InterContinental Hotels Group PLC, or IHG (which has the Hotel Indigo on Washington Boulevard) and Choice Hotels International Inc. (which has the Cambria Hotel on West Lafayette and the Quality Inn on East Jefferson).

Denton also agreed that some markets are squarely in control of one of the two top brands.

“It’s not unusual at all for one brand or another to develop a dominant presence in a market, at least in the short term,” said Denton, with the Broad school at MSU.

Emails were sent to spokespeople for Marriott and Hilton on Monday seeking comment.

For Molinari, adding more chain competition to the downtown market would be welcomed.

“We’d love to diversify because when you’re so stocked with one group, it does potentially take away some of the competition, although Marriott has been fantastic in working with us on major groups,” Molinari said.

While Marriott is currently king of Detroit hospitality, there are plenty of unknowns about future hotel uses in the pipeline, some of which could ultimately become Hilton properties.

For example, the Ilitch family’s Olympia Development of Michigan real estate company and New York City-based Related Cos. have proposed a pair of new downtown hotels that do not yet have announced flags: A $190.5 million, 290-room 14-story hotel immediately south of Little Caesars Arena, as well as a conversion of the Fox Office Building above the Fox Theatre into a 177-room property.

Olympia is in pre-development on those two hotels and “cannot comment on any ongoing deals at this time,” a spokesperson said in an email.

Credit: Nick Manes /Crain’s Detroit Business

The exterior of the 227-room Godfrey Hotel, a Hilton property, on Michigan Avenue between Trumbull and Eighth Street.

In addition, there are unknowns about the former Detroit Police Department headquarters at 1300 Beaubien St. and the former Roberts Riverwalk Hotel at 1000 River Place Dr. on the Detroit riverfront, both properties owned by Dan Gilbert’s Bedrock LLC.

“Bedrock’s hospitality portfolio sees tremendous demand, from the Courtyard by Marriott to boutique options such as Roost Detroit at Book Tower and Shinola Hotel that has earned a prestigious Michelin Key,” Kofi Bonner, CEO of Bedrock, said in a statement. “The continued demand for high quality, branded and experiential accommodations drives Bedrock’s decision making for future concepts — including the anticipated arrival of The Detroit Edition.”

It was the dearth of Hilton properties that led to what became the Godfrey Hotel in Corktown, said John Rutledge, founder, chairman and CEO of Chicago-based Oxford Capital Group LLC and Oxford Hotels & Resorts LLC, one of the development partners on the hotel.

“Both Hilton and Marriott are powerful brand families globally and Oxford owns and manages assets around the country under both affiliations,” Rutledge said. “But we decided to go with the Hilton Curio ‘soft brand’ affiliation for our Godfrey Corktown here, given the relative underrepresentation of Hilton product downtown and due to Curio’s upper upscale ‘luxury lifestyle’ positioning.”

Credit: Stephanie Rhoades Hume/Michigan Central

A luxury NoMad hotel, a Hilton brand, will take over the 14th through 18th floors of the Michigan Central Station building in Detroit’s Corktown neighborhood. Seen here is the 17th floor.

Last week, Michigan Central, the nonprofit that operates the 30-acre Michigan Central autonomous and electric vehicle campus in Corktown anchored by the redeveloped train station, said NoMad is opening a 180-room luxury hotel in the building’s top floors.

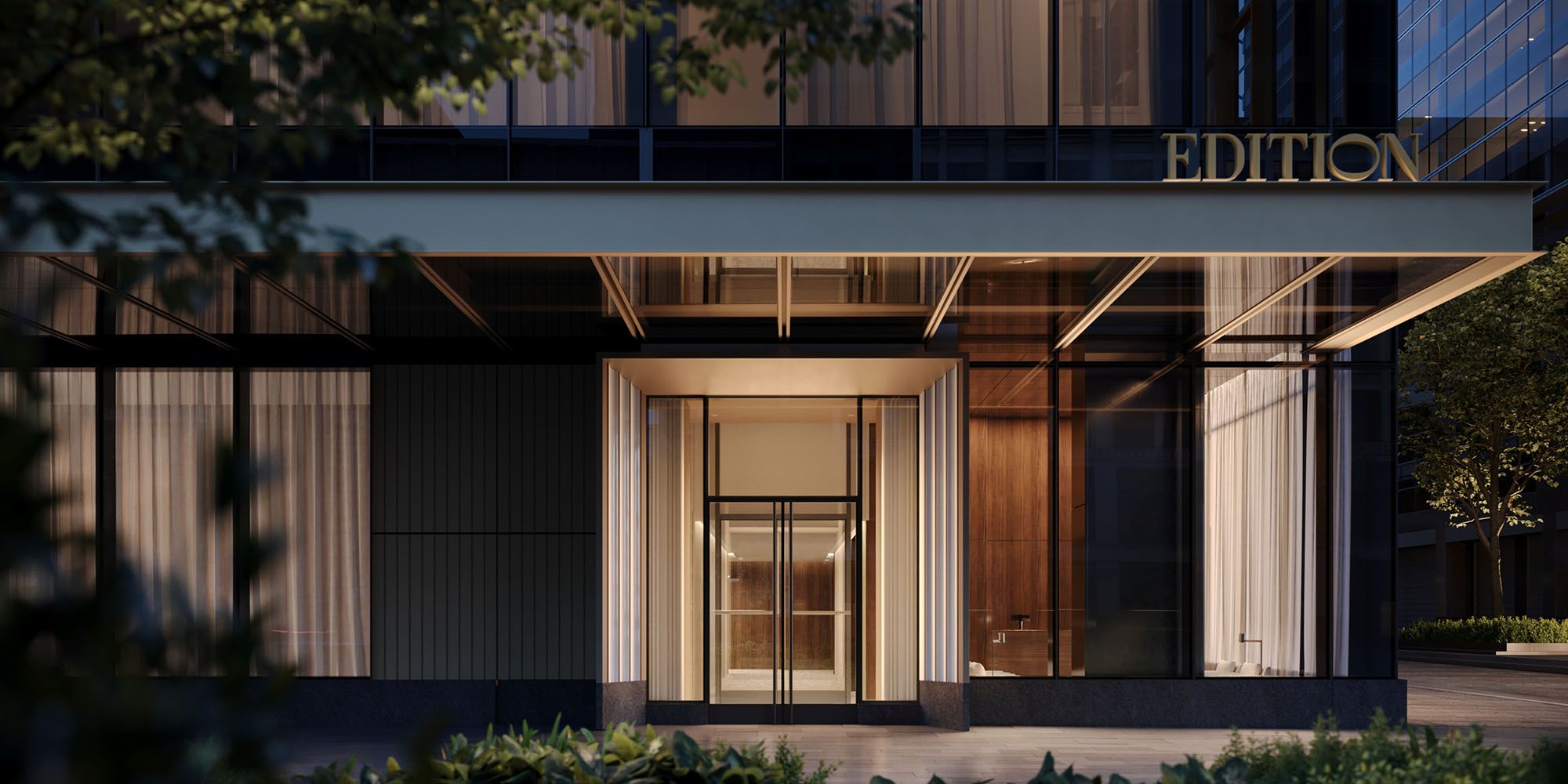

That hotel is on track to open in 2027, right around the same time as the Edition hotel by Marriott, which was announced in 2022 and is a flag developed by Ian Schrager, one of the co-founders of the storied Studio 54 in New York City.

That puts the city on track to get two five-star hotels in the span of 12 months or less, when it previously had none.

Credit: Bedrock

This rendering shows the entrance to the Edition hotel, a Marriott brand, and condos at Hudson’s Detroit in downtown Detroit.

In 2024, Hilton paid what hotel industry publication Skift reported was $56 million for a majority interest in Sydell Hotels & Resorts LLC and Sydell Holding Company IUK Ltd., with plans to scale up the NoMad brand from just one currently operating hotel to up to 50 worldwide.

Skift reported that over time, Hilton’s NoMad could ultimately rival competitor Marriott’s Edition hotel brand.

When Hilton announced the Sydell deal in April 2024, it said there were 10 or so NoMad hotels “already in advanced stages of discussion.”

NoMad was founded in 2011 and takes its name from the New York City neighborhood Madison Square North in Manhattan.

The Edition hotel brand was announced in early 2008 as a collaboration between Schrager and Marriott. At the time, they said there were development agreements for an initial nine Edition hotels in Los Angeles (two), Paris, Madrid, Costa Rica, Miami, Washington, D.C., Chicago and Scottsdale, Ariz.

Owning a home is a keystone of wealth… both financial affluence and emotional security.

Suze Orman